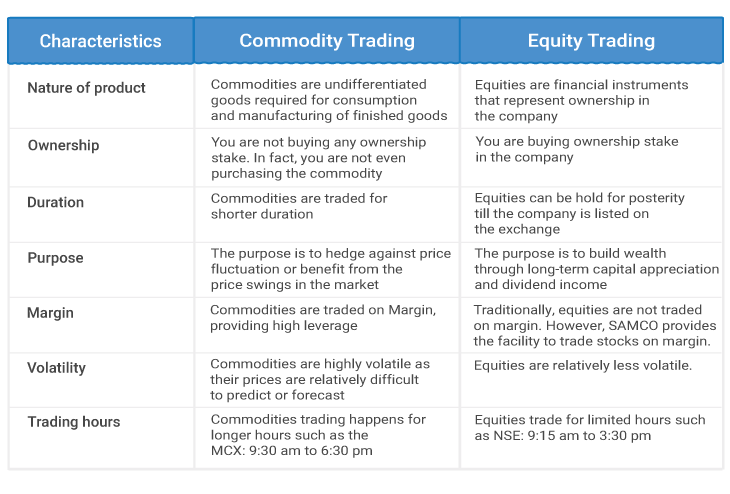

A comparison chart between commodities trading and equity trading

Commodity Trading vs Equity Trading

Commodity trading is trading in food items or basic necessities such as cocoa, wheat, rice, cattle, etc. which are fundamental in fulfilling the basic needs of any human being or necessary raw materials that are extracted or excavated from earth or natural resources.

Traders buy and sell commodities to hedge against price fluctuation or protect the portfolio from the effects of inflation. However, there are also speculators looking for quick, short-term gains in commodities trading.

Equity trading, on the other hand, is trading in the shares of public limited companies that are engaged in the processing, manufacturing or marketing of finished goods. Ordinarily, such companies are involved in the conversion of commodities into saleable, finished goods, or any activity associated with the distribution of finished goods.

A share represents the extent of ownership in the company. People trade in equities to generate wealth through dividends or capital appreciation.

Let us have an incisive look at some of the difference that sets apart these two distinct mediums of attaining monetary gains.

[Suggested Reading: What is commodity Trading]

Nature of product

Commodities constitute primary raw materials required in the manufacturing and processing of finished goods, and necessary items for consumption needed for daily subsistence. Commodities can be easily substituted with one another, which means they are interchangeable, with no qualitative differences.

Equities are financial instruments that represent an ownership stake in the company. The company is liable to share the profits of the company with the equity holders after retaining a portion of the earnings for future growth and development and after fulfilling all the debt obligations. They share the profits in the form of dividends. However, you can also garner profits in the equities market through achieving a higher value than the capital invested, by selling the shares at a higher price than the price at which they were owned. Hence, the purpose of investing in equities is majorly dividends and capital appreciation.

Ownership

When you are buying commodities, you are not buying any ownership stake in the company. There is no company involved in the entire trade. The most common route to invest in commodities is through commodity futures. In fact, when you are purchasing commodity futures, you are not buying the tangible commodity, you are merely purchasing a contract that represents it, that only derives its value from the underlying commodity

When you are buying shares, you are effectively taking ownership in the assets of the company. A share represents an ownership stake in the company.

Duration of trade

Commodities are traded for a shorter duration. The typical way of investing in commodities is through commodity futures and options. The futures have an expiry date by which you can buy or sell the underlying commodity. And even options have an expiry date by which you can exercise the right to buy or sell the underlying commodity. Hence, trading in commodities usually involves an expiry date.

While stocks can be traded over a short term, the most popular strategy of investing in equities is the buy and hold strategy. Many financial gurus preach this strategy. Basically, you invest in stocks with a long-term horizon to create considerable wealth based on capital appreciation in the total value of the portfolio. You can hold the stocks for the lifetime of the company until the company is solvent and listed on the exchange. There is no expiry date when you are obliged to sell or buy the shares

Purpose

Commodities are majorly used by producers of commodities to hedge against adverse fluctuation in the prices of the commodity by locking in a guaranteed price. However, a speculator may attempt to benefit from swings and volatilities in the prices of these commodities through quick and short-term trades.

The purpose of trading in equities is wealth creation. Equities are also used for hedging. But the primary purpose of equities is placing bets on companies with a high potential to churn out profits.

Margins

Commodity trading is renowned for the leverage it provides. You merely need to deposit a fraction of the total value of trade as an initial margin to gain exposure to a relatively higher value.

Commodity trading requires extremely low margins. As the profit or loss is accounted for by the total value of trade, marginal movements in the prices of commodities can result in substantial gains or enormous losses.

Traditionally, equity stocks are not traded on margin; you must pay the entire value of trade to purchase any shares. However, SAMCO securities provide the option to buy shares on margin.

Volatility

Commodities are highly volatile as it is majorly influenced by the supply and demand factors. The supply and demand of commodities are affected by unforeseen circumstances such as war, riots, man-made disasters, natural disasters. etc. Also, the prices of commodities remain largely unaffected. Hence, any unpredictable event triggers wide fluctuations in the prices of the commodities, majorly due to unpreparedness of the market to withstand such a sudden change in demand and supply.

Equities are less volatile. Stock prices fluctuate in response to the market sentiments, the status of the economy and company fundamentals. Hence, due to the constant evolution of prices, the degree of change in the prices of the equities is relatively less. Also, temporary economic conditions affect the prices of the equities in a limited way due to the anticipation of such periods of booms and busts already factored in the prices of the equities beforehand. Also, an astute investor would invest in equities for the long haul as compared to a seasoned commodity trader who must track the daily movements in the prices of the commodities as he seeks to profiteer from such price fluctuations through short-term trades. Hence, investors remain unaffected from temporary price movements in the stock market, contributing to lower volatility in the prices of equities.

Watch this video to learn how tracking commodity markets can help you make profits in equities.

Trading hours

Commodity exchanges are open for longer hours such as the MCX which functions from 9.30 am to 6.30 pm

Stock exchanges operate for shorter hours compared to commodity exchanges. E.g. NSE functions from 9.15 am to 3.30 pm.

To conclude, the distinction between commodity trading and equity trading will help you determine the investment or the trading route you need to take based on your profile, risk/return ability and requirements.

E.g., for a young investor who wants to build a sizable wealth for retirement, equities is the preferred route. However, a farmer who merely wants to lock-in a price for his produce that guarantees him a reasonable rate of return, and assures him a buyer to deliver to at the time of the harvest, commodities trading is the preferred way.

Whether you choose equity trading or commodity trading, Samco provides the best trading account in India which gives you access to trade across equity, commodity and currency markets to create infinite wealth!

Open a Samco trading account in just 5 minutes and explore unlimited wealth creation opportunities today.

By Deepika

KhudeDeepika

Khude

The author is a Certified Financial Planner (CFP) with 5 years

experience in Investment Advisory and Financial Planning. Her strength lies in

simplifying complex financial concepts with real life stories and analogies. Her goal

is to make common retail investors financially smart and

independent., Samco.in | Last Updated: Jun 21, 2022

Easy & quick

Easy & quick