How does leverage work in Forex trading?

Leverage in forex trading gives the investor the power to control something big with something small.

Leverage in forex trading is essentially a short-term loan provided by your broker which helps you control large positions with less capital.

For new investors, the forex market might seem boring as the exchange rates move at a snail's pace especially when compared to the stock market. But what makes the currency market the most liquid and opportunity-rich market in the world is “Leverage”.

For example, imagine you expect the USD/INR rate to appreciate and want to profit from it. So, if you want to buy 1 USD/INR contract at Rs 73.2560, then without leverage, you will have to pay Rs 73,256 from your own pocket (1 standard USD/INR lot is 1,000 units). But you only have Rs 10,000 in your trading account.

So, what do you do?

Do you give up on your dream to make wealth in currency trading?

Do you have to be rich to become rich?

The answer is No.

You can create unlimited wealth in currency trading with less capital by using “Leverage”

Today, we are going to learn how leverage works in forex trading, how to utilise leverage to multiply your profits and also understand:

-

» What is leverage in Forex trading?

-

» What is margin?

-

» What is the relationship between margin and leverage ratios?

-

» What are the different types of leverage ratios and their meaning?

-

» How does leverage work in Forex trading?

-

» Which is the best leverage ratio?

-

» How to manage leverage risk?

-

» How to calculate leverage in Forex trading?

-

» FAQs

What is leverage in Forex trading?

Leverage in forex trading is the capital that you borrow from your broker for the short-term which enables you to control a big position with a relatively small capital and maximise your profits.

Leverage in forex trading is expressed as a percentage or “X” of your deposit.

So, if you have Rs 10,000 in your forex trading account and your broker provides you a 10X leverage, then you can take positions upto Rs 1 lakh. Similarly, if your broker provides you a 50X leverage, you can trade up to Rs 5 lakhs.

Leverage in forex trading can go as high as 100x and is dependent on the forex margin. Samco provides very high leverage in forex trading against a small forex margin.

[Suggested Reading: How to Open a Forex Trading Account?]

What is Forex margin?

If leverage is the short-term loan from your broker then forex margin is the security deposit that you need to maintain with your broker to get the loan i.e. leverage. Forex margin is a small percentage of the total position.

What is the relationship between Forex margin and Forex leverage?

Forex margin and forex leverage have an inverse relationship. So,

Lower the margin required = Higher the leverage provided &

Higher the margin required = Lower the leverage provided

| Margin Requirement | Leverage Ratios |

|---|---|

| 0.25% margin | 400:1 |

| 0.50% margin | 200:1 |

| 1% margin | 100:1 |

| 2% margin | 50:1 |

| 5% margin | 20:1 |

| 10% margin | 10:1 |

As evident in the above table, when the forex margin requirement is only 0.25%, the broker is willing to provide a leverage of 400x i.e. 400 times, but when the forex margin requirement is 10% the leverage provided is only 10x i.e. 10 times.

Types of leverage ratios and their meaning

| Leverage Ratio | What it means |

|---|---|

| 1:20 Leverage | For every Rs 10,000 forex margin, you can take positions up to Rs 2 lakhs |

| 1:50 Leverage | For every Rs 10,000 forex margin, you can take positions up to Rs 5 Lakhs |

| 1:100 Leverage | For every Rs 10,000 forex margin, you can take positions up to Rs 10 Lakhs |

| 1:400 Leverage | For every Rs 10,000 forex margin, you can take positions up to Rs 40 Lakhs |

How does leverage work in Forex trading?

Now, that you understand the basics of leverage in forex trading, let us understand how leverage works in forex trading.

Mr. Shyam, an accountant, expects the USD/INR rate to appreciate and buys the USD/INR 1-month futures contract, currently trading at Rs 73.3834.

But he only has Rs 10,000 to maintain as the forex margin. By using the margin calculator and the high leverage provided by Samco, he was able to buy 17 lots in Intraday.

As expected, the USD/INR appreciated from 73.3834 to 74.3834, and Ram made a profit of 170%!

| Capital Invested | 1 USD/INR | Lots Acquired | Total Margin Required | Total Value of position | leverage Provided | USD/INR | Sale Price | Profit | Profit % |

|---|---|---|---|---|---|---|---|---|---|

| Rs 10,000 | 73.3834 | 17 | Rs 9,979 | Rs 12,47,518 | 120x | 74.3834 | Rs 12,64,518 | Rs 17,000 | 170% |

In the above example, the Rs 9,979 is the margin required i.e. the collateral to be maintained with the broker, and by allowing Ram to take a position of Rs 12.47 Lakhs against Rs 9,979, Samco gave him leverage of 120x.

So, Ram made 170% profit in intraday, much higher than what mutual funds or stocks could offer. This is the power of leverage in forex trading.

Leverage - A double-edged sword?

While forex leverage makes an otherwise boring currency market interesting and might seem like a sweet deal, remember, too much sugar can cause diabetes!

In the above example, had the USD/INR depreciated from 73.3834 to 72.3834, Ram would have lost his entire capital of Rs 10,000 in a single day!

When dealing with leverages as high as 120 times, even a 50 paisa fall can erode the invested capital. In Mr Ram’s case, with every 50 paisa fall, his loss increased.

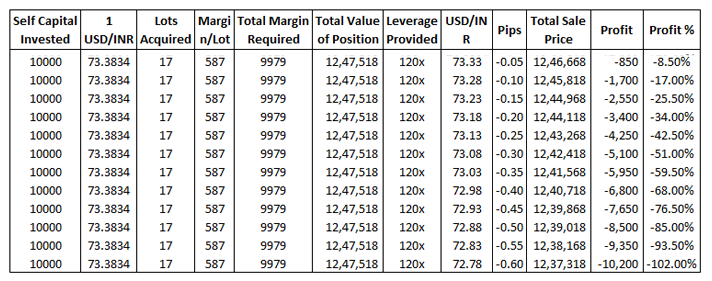

Table: How a 50 paise fall erodes wealth with high leverage

So, you need to be very careful while selecting a forex leverage ratio. You should also have sound risk management in place to counter the double-edged-sword nature of leverage in forex trading.

Which is the best leverage ratio for beginners in the Forex market?

Undoubtedly, leverage is the main attraction of the forex markets. Without forex leverage, traders might have to wait for months to see a 10% change in their positions.

But as attractive as it might seem, leverage in forex is a risky proposition. While selecting the best leverage ratio, you should keep the below three rules in mind:

Always start with low leverage in forex trading.

Always use a stop-loss to protect your capital and minimise your loss

Always expose only 1% - 2% of your capital in each trade.

There is no fixed formula for selecting the best leverage ratio. It depends on your risk profile, how much capital you want to risk and how much volatility you can handle.

How to manage leverage risks?

We have all heard, ‘with great power comes greater responsibilities’. This is especially true in the case of forex markets because of how leverage works in forex trading.

A mere Rs 10,000 gives you the power to control positions worth Rs 10 Lakhs at 100x leverage!

While forex leverage is a boon when the markets are in your favour, they soon become a nightmare when the markets move against you.

But that does not mean that you should give up on forex trading.

The best way to manage high leverage risk is to deploy a stop-loss on each trade. Let us see how stop-loss works in reducing your loss.

Managing leverage risk with stop-loss

Let’s go back to Mr Ram and his expectation that the USD/INR would appreciate from 73.3834 to 74.3834. Hoping to make a gigantic profit, Mr Ram bought 17 lots of USD/INR at Rs 73.3834.

But, this time, his prediction was wrong and the USD/INR started depreciating. With every 50paise fall, Ram’s loss was increasing. But being a smart forex trader, Ram deployed a stop-loss at Rs 73.2500.

A stop-loss is a feature that helps you limit your loss. In the above example, even if the USD/INR falls to 72.3834, since Ram has a stop-loss at Rs 73.2500, the system will automatically close his position once USD/INR hits 73.2500. So, even though he could have lost all his money, a stop loss helped him stop his loss at Rs 2,268 only.

| Capital Invested | 1 USD/INR | Lots Acquired | Total Margin Required | Total Value of position | leverage | USD/INR | Sale Price | Loss | Loss % |

|---|---|---|---|---|---|---|---|---|---|

| Rs 10,000 | 73.3834 | 17 | Rs 9,979 | Rs 12,47,518 | 120x | 73.25 | Rs 12,45,250 | Rs 2,268 | 22.68% |

To conclude, forex leverage and forex trading might seem tricky at first, but like anything else in life, to become a successful trader you need to practice. The more you practice, the more opportunities you will create to generate wealth.

To aid your wealth creation journey, we have separately covered the top 10 tips for forex trading in India.

Another prerequisite to becoming a successful forex trader is to find the best forex partner. Samco, with its high leverage-low margin mantra and best forex trading platform in India, is your perfect match.

Samco is India’s leading forex broker and provides the best forex trading platform in India at only Rs 20/trade.

Financial Leverage is the advantage the rich have over the poor and the middle class

- Robert Kiyosaki

So, start using forex leverage to become rich now!

Easy & quick

Easy & quick