Introduced in 1996, Demat accounts have transformed the trading style of investors in the country. It has efficiently eliminated issues like loss, theft, forgery, Vanda trades etc associated with physical share trading. But insufficient knowledge regarding how to use a Demat account, or how to buy shares using a Demat account has been a major roadblock for retail participation in the stock markets.

But today, we are going to address all your queries regarding how to use a Demat account, how to transfer shares using a Demat account and much more. So, let’s get started.

In this article we cover :

-

» How to transfer shares using a Demat account?

-

» How to sell shares in a Demat account using e-dis?

-

» How to convert physical share certificates into Demat form?

-

» How to create a pledge of securities in a Demat account?

-

» How to set up a margin pledge from a Demat account?

-

» What are the best practices for using a Demat account?

How to transfer shares from one Demat account to another Demat say Samco Demat account?

You can transfer your shares from one Demat account (existing Demat account) to your new Demat account (Samco Demat account) in 2 ways:

-

Close your existing Demat account and transfer all your holdings at one go (Recommended)

In case clients chose this mode of transferring securities, they can end up saving costs on off-market transfer of shares which shall otherwise be applicable if single/specific securities are transferred from one Demat account to another. This is because SEBI mandates that in case of closure cases, no charges can be levied by the DP as can be levied in case of off market transactions. No charges shall be levied by SAMCO for such incoming transactions but the existing DP may charge for outgoing transactions.Steps:

Request a Client Master Report Copy i.e. CML copy from the target Depository participant i.e. in this case SAMCO Account.

This CML copy shall contain exhaustive details like your Name, PAN, Date of birth, BO ID, etc. CML copy is sent to you at the time of your account opening. In case you haven’t received the same, you can request a copy by raising a support ticket at www.samco.in/supportSubmit the CML Copy to your existing Depository Participant along with an account closure form and Delivery instruction slip of your existing Demat account

Once you submit these documents, your existing depository participant shall execute the instruction and transfer your securities.Confirm that your stocks have been credited to your SAMCO Demat account

As a prudent practice it is advisable to double check that the credit has been received at your target Demat account i.e. in this case SAMCO Demat account.

Transfer specific securities from your existing Demat account to your new SAMCO Demat Account

In case clients chose this mode of transferring securities, they shall be liable to incur off market transaction charges that shall be levied by the existing DP. No charges shall be levied by SAMCO for such incoming transactions but the existing DP may charge for outgoing transactions.Steps:

Identify the type of transaction to be stated on the DIS slip to be issued – within CDSL off market or Inter DP i.e. between NSDL and CDSL

In case your existing account is an NSDL account, you shall be required to select the Inter DP option/Transfer Outside CDSL option and in case your existing Demat account is a CDSL account, then you shall be required to select the within CDSL option.Issue a delivery instruction slip of your current/existing Demat account to your depository participant

While submitting this delivery instruction slip correctly enter your SAMCO BO ID i.e. a 16 digit BO ID which starts with 12054200 followed by (Your 8 Digit SAMCO DP Client ID) Ex. 12054200XXXXXX52. In case you don’t have your BO ID handy, you can request for the same by raising a support ticket at www.samco.in/support

![How to use a Demat Account]()

Confirm that your stocks have been credited to your SAMCO Demat account

As a prudent practice it is advisable to double check that the credit has been received at your target Demat account i.e. in this case SAMCO Demat account.

How to create a pledge of securities in my Demat account?

Here are the steps to create a pledge of securities that are held in your Samco Demat account:

Pledgor and Pledgee shall have account in CDSL only

The pledgee’s Demat account could be in Samco Securities DP or another DP as well.Pledgor to submit Pledger request form to Depository participant - Samco

This shall be submitted in duplicate copies

![How to use a Demat Account]()

Samco Securities i.e. the Depository participant shall setup a pledge in the Depository system

A unique PSN i.e. Pledge sequence number shall be generated.Pledgee to accept the Pledge through it’s DP

In case the Pledgee has standing instructions to accept pledges, this step shall be skippedPledge is created

Once the pledge is accepted by the pledgee, pledge of the pledgors securities is created in the Depository system.

How to sell shares from Demat account using a e-dis?

With effect from May 2020, in case customers have not submitted a limited purpose power of attorney from their Samco Demat account, they shall be required to generate a pre-trade e-DIS instruction slip to sell shares held in their Demat account. Check out the step by step process on how to sell shares using eDIS system of CDSL.

How to setup a margin pledge from a Demat account?

A margin pledge is different from a normal pledge. A margin pledge is a pledge that is done in favour of your stock broker i.e. Samco Securities Limited for purposes of fulfilling margin obligations of the trading account, mostly for the equity derivatives or currency derivatives segment. This is the type of pledge that is used for getting margin against shares with StockPlus. Here are the steps to create a margin pledge of securities that are held in your Samco Demat account:

Pledgor i.e. customer to initiate a pledge request from the Back office Samco Star

Customer shall be required to select the quantity and the ISIN/security to be pledged. Only permissible securities shall be available from margin pledging.

![How to use a Demat Account]()

Samco Securities i.e. the Depository participant shall initiate setting up a margin pledge in the Depository system

A unique PSN i.e. Pledge sequence number shall be generated by Samco and send to CDSL and CDSL shall in turn send an link for confirmation on the customer registered email and mobile for confirmation.Customer to confirm the margin pledge on CDSL’s web page received on email/mobile.

This confirmation can be done by entering the CDSL TPIN. This works as a dual confirmation of pledge.Margin Pledge is created

Once the pledge is accepted by the pledgee, margin pledge of the clients securities is created in the Depository system.

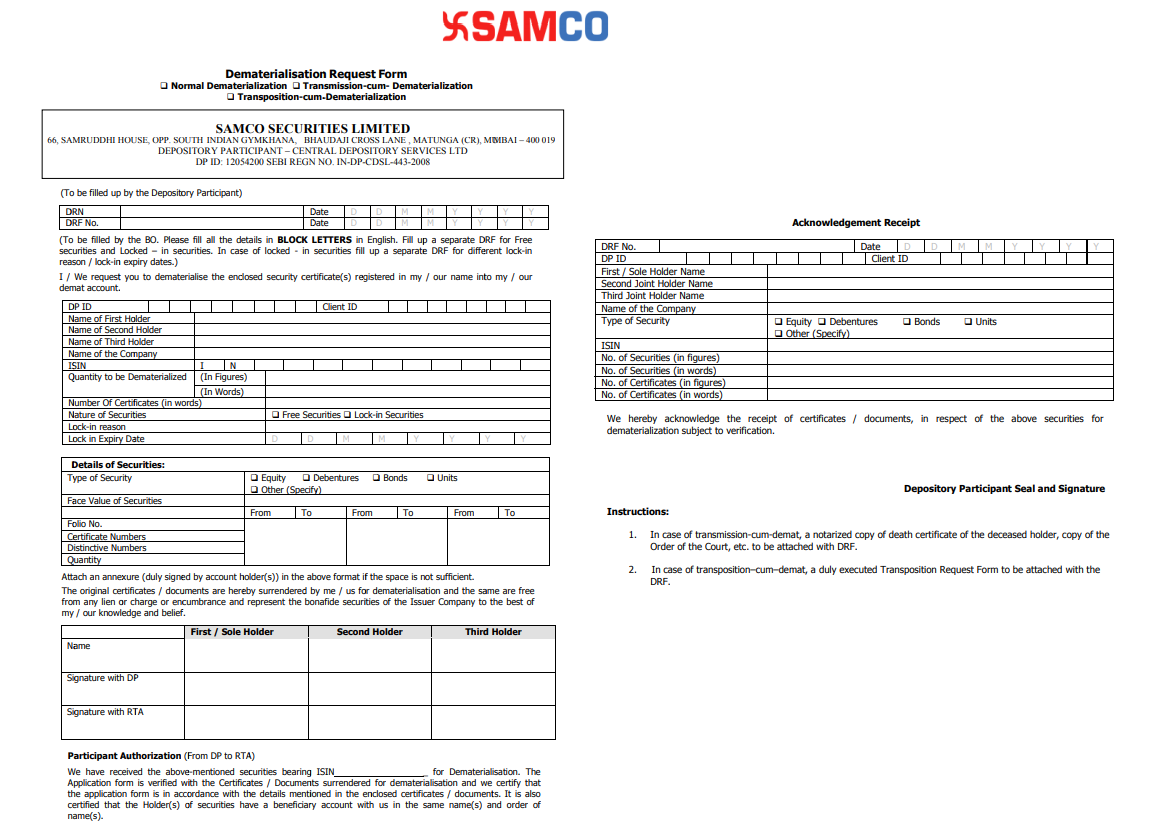

How to convert physical share certificates to Demat form?

The process of converting physical share certificates to Demat form is known as Dematerialisation.

The steps for converting physical share certificates to Demat form are as follows:

Submit Demat Request form (DRF) to DP i.e. Samco Securities Limited

A filled and signed DRF along with the physical share certificates needs to be submitted to our office.

![How to use a Demat Account]()

DP i.e. Samco Securities Limited will setup the Demat request with Depository system.

Samco will verify the details and setup the Demat request in the DP system. We will then also deface and mutilate the certificate and send the same along with the DRF to Issuer company and the RTA i.e. Registrar of the company.Confirmation by Issuer and RTA

On receipt of confirmation by the issuer/RTA, the securities shall be credited to the customers Demat account held with Samco.

As a bonus, let us look at the best practices for using a Demat account.

Best practices for using a Demat account

Submit Demat Request form (DRF) to DP i.e. Samco Securities Limited

It is advisable to hold two separate Demat accounts from an income tax point of view - one for trading and the other for long-term investments. This is because otherwise, in certain cases, assessing officers may decide that all transactions are of trading nature and classify the income as business income, which is taxable at higher rates. Segregating the two accounts clears all doubts and will ensure that you can enjoy the benefits of lower capital gains on long-term investments.Reconcile dividends and other corporate actions for securities in Demat account

Investors should periodically reconcile all corporate actions received in form of dividends, right entitlements, splits, bonus shares, etc and ensure that all the benefits have been correctly enjoyed by them. In case shares are pending for settlement in brokers pool accounts, make sure appropriate credits are given to the trading ledger account in such cases.Recording off-market transfers correctly from accounting point of view

It is very critical that off market transactions by way of gifts/purchase/sale are recorded correctly in an investors books of accounts. This is to ensure compliance with income tax laws as well as anti-money laundering laws.

In case you have any specific queries pertaining to your Demat account, please raise a support ticket on our helpdesk www.samco.in/support and we shall be happy to help.

By Deepika

KhudeDeepika

Khude

The author is a Certified Financial Planner (CFP) with 5 years

experience in Investment Advisory and Financial Planning. Her strength lies in

simplifying complex financial concepts with real life stories and analogies. Her goal

is to make common retail investors financially smart and

independent., Samco.in | Last Updated: Jun 21, 2022

Easy & quick

Easy & quick